Picture this: You come home to find your living room flooded, or your car dented in a parking lot. In these moments of distress, knowing how to properly file an insurance claim for property damage can make all the difference. To help you navigate this process with ease, we have compiled a list of dos and don’ts to ensure a smooth and successful experience. So, grab a pen and paper, and let’s dive into the dos and don’ts of filing an insurance claim for property damage.

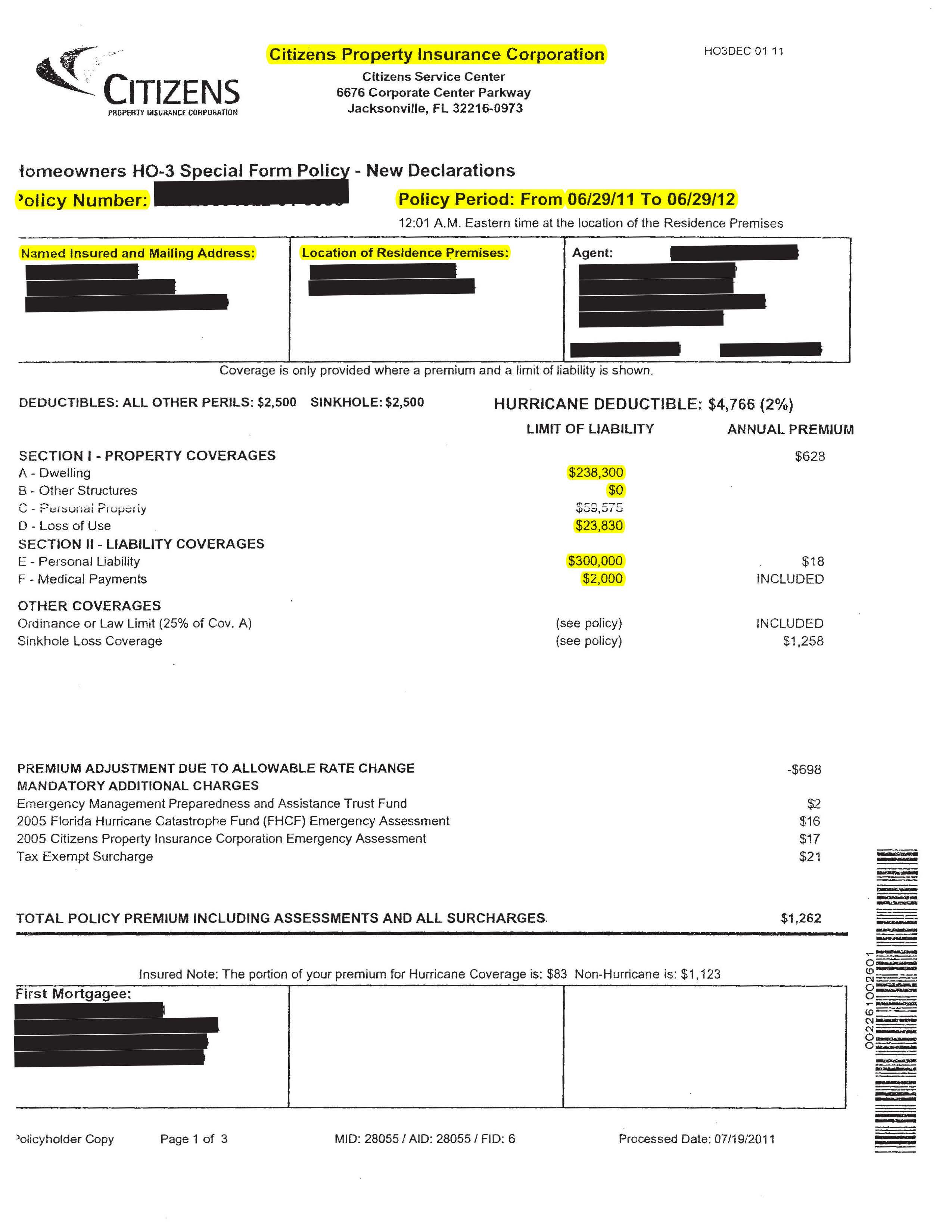

Understanding Your Policy Coverage

When filing an insurance claim for property damage, it is important to understand the dos and don’ts to ensure a smooth and successful process. One key aspect to remember is to DO document the damage thoroughly with photos and videos before making any repairs. This will provide essential evidence for your claim and help speed up the process.

On the other hand, a common mistake to avoid is NOT waiting too long to file your claim. It is in your best interest to notify your insurance company as soon as possible after the damage occurs. Delaying the claim could potentially result in a denial of coverage, so act promptly to protect your investments.

Documenting the Damage Properly

When it comes to documenting the damage to your property for an insurance claim, it’s essential to follow the proper steps to ensure a smooth and successful process. One of the key dos is to take thorough and detailed photos of the damage from multiple angles. These photos will serve as crucial evidence when filing your claim and can help support your case.

On the flip side, one of the major don’ts is to delay in documenting the damage. It’s important to capture the extent of the damage as soon as possible to prevent any further complications or disputes with the insurance company. Additionally, **make sure to keep all receipts and invoices related to any repairs or temporary accommodations**, as these will also be necessary when submitting your claim.

Taking Necessary Actions Promptly

When filing an insurance claim for property damage, it is crucial to take necessary actions promptly. One of the key dos is to document the damage thoroughly. Take photos and videos of the affected areas, and make a detailed list of all damaged items. This documentation will help support your claim and ensure you receive proper compensation.

On the flip side, one of the don’ts is to delay contacting your insurance company. It is important to notify your insurer as soon as possible after the damage occurs. Waiting too long can result in your claim being denied or delayed. Additionally, be sure to provide accurate information when filing your claim to avoid any potential issues down the line.

Avoiding Common Pitfalls

In order to successfully file an insurance claim for property damage, it’s important to be aware of the common pitfalls that can hinder your claim. One of the most important dos is to document the damage thoroughly. Take photos and videos of the damage from multiple angles to provide clear evidence to your insurance company. Also, make sure to keep all receipts and invoices related to repairs or replacements.

On the other hand, one of the biggest don’ts is to delay in filing your claim. It’s crucial to report the damage to your insurance company as soon as possible to avoid any delays in the claims process. Additionally, don’t forget to review your policy carefully to understand what is and isn’t covered, and avoid making any repairs before your insurance company has had a chance to assess the damage. By following these dos and don’ts, you can navigate the insurance claims process more effectively and avoid common pitfalls that can delay or deny your claim.

Wrapping Up

In conclusion, navigating the insurance claim process for property damage can be a daunting task. By following the dos and don’ts outlined in this article, you can ensure a smoother and more successful experience. Remember to document thoroughly, communicate effectively, and avoid common pitfalls that could jeopardize your claim. With the right approach, you can protect your property and secure the coverage you deserve. Good luck!