Navigating the waters of marriage can be a thrilling and joyful experience, but it can also bring a host of new challenges, including how to manage your finances as a couple. Building a solid financial foundation together is key to ensuring a long and happy partnership. In this article, we will explore the importance of financial planning for newlyweds and provide tips on how to successfully navigate this aspect of married life.

– Setting Joint Financial Goals

When embarking on a new life together as newlyweds, setting joint financial goals is a crucial step in building a solid foundation for your future. By working together to establish clear objectives and priorities, you can create a roadmap that will guide your financial decisions and aspirations as a couple.

**Some key points to consider when setting joint financial goals include:**

- **Communication:** Open and honest communication about your individual financial goals and priorities is essential to aligning your joint goals.

- **Collaboration:** Work together to establish realistic and achievable goals that reflect your shared values and aspirations.

- **Compromise:** Be willing to make compromises and adjustments to achieve a balanced and harmonious approach to your financial planning.

– Creating a Budget That Works for Both Partners

When it comes to starting a new life together, one of the most important aspects for newlyweds to consider is their finances. Creating a budget that works for both partners is essential in building a solid financial foundation for the future. By combining their resources and working together towards common financial goals, couples can ensure a successful and secure financial future.

Here are some tips to help newlyweds create a budget that works for both partners:

- Open communication: Discuss your financial goals, priorities, and concerns openly and honestly with each other.

- Combine finances: Consider merging your finances into a joint account to streamline bill payments and savings goals.

- Set realistic goals: Establish short-term and long-term financial goals that are achievable and align with both partners’ aspirations.

– Establishing Emergency Savings and Long-term Investments

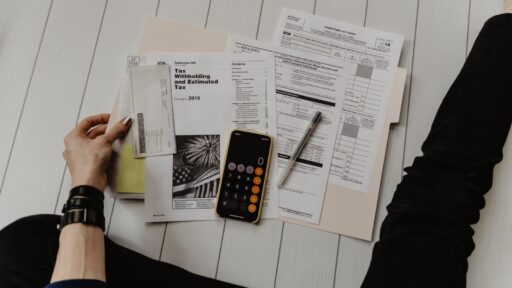

When starting a life together as newlyweds, one of the most important steps to take is establishing emergency savings and long-term investments. Building a solid financial foundation is crucial for ensuring stability and security in the years to come.

Setting up an emergency fund is essential for unexpected expenses that may arise, such as medical bills, car repairs, or home maintenance. This fund should ideally cover three to six months’ worth of living expenses. Additionally, investing in long-term savings options, such as retirement accounts or mutual funds, can help you achieve your financial goals and secure your future together. By prioritizing both emergency savings and long-term investments, you can set yourselves up for financial success and peace of mind.

– Managing Debt Effectively as a Team

When it comes to managing debt effectively as a team, communication is key. As newlyweds, it’s important to sit down and have an open discussion about your financial goals and priorities. By establishing a solid financial plan together, you can work towards building a strong financial foundation for your future. Here are some tips to help you manage debt as a team:

- Set financial goals: Discuss your short-term and long-term financial goals as a couple. Create a budget that aligns with these goals and stick to it.

- Track your spending: Keep track of your expenses to identify areas where you can cut back and save money. Consider using budgeting apps or spreadsheets to help you stay organized.

- Pay off debt together: Work as a team to tackle your existing debt. Consider consolidating high-interest debts or setting up a debt repayment plan to help you pay off debt faster.

By working together to manage debt effectively, you can strengthen your relationship and build a solid financial future for yourselves. Remember, it’s important to be transparent with each other about your financial situation and be supportive as you work towards your shared financial goals.

Final Thoughts

As you embark on this new journey together as newlyweds, remember that strong financial planning is key to building a solid foundation for your future. By working together to set goals, create a budget, and communicate openly about your finances, you can ensure a stable and secure future for yourselves and your family. Remember, it’s not about how much money you make, but how well you manage and plan for your financial future that truly matters. Here’s to a lifetime of financial wellness and happiness together!